The Best Class to Buy

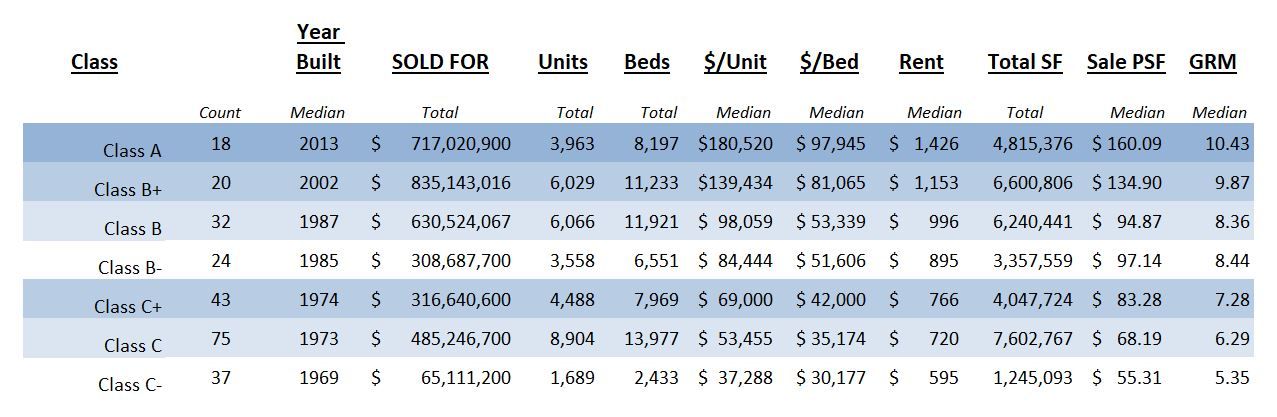

The chart below shows statistics for a study conducted from June 2017 to June 2019 in 5 Florida markets combined (Volusia County, Jacksonville/St. Augustine, Tallahassee, Gainesville, and Ocala). The closing stats are broken down based on the following class ranks: A, B+, B, B-, C+, C, and C-. These sales include both student and market rate but market rate sales make up 92% of all sales.

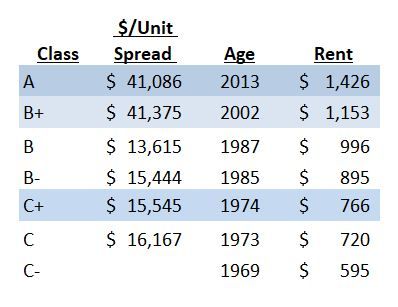

This smaller chart shows the $/unit increase from one class rank over the next, as well as the median age and rent at the time of close. There is a huge jump in value going from B to B+ and from B+ to A. But a closer look is needed. The median age of a B class sale is 1987 with $996/month rents at time of sale. The median age of a B+ class sale is 2002, which is 15 years newer, and has $1,153/month rents, which is 16% higher. So, the key is to buy B class assets that are as close to the 2000s or newer construction as possible. In looking at all the B sales for the trailing 24 months, there were numerous sales that qualify in this construction age. Therefore, Class B seems to be the best class rank value to buy.

The 2nd best class rank to buy is B+. While it's a much tougher transition to realize with a full $41,000 per unit bump, there are plenty of data points between a $139k+/unit class B+ sale and a $180k+/unit class A sale to still be handsomely rewarded. The challenge is that the median age of a class A sale is 2013 with $1,426/month in rents, while a class B+ has a median age of 2002 and a median of $1,153/month in rents. That’s an 11-year difference in age and a $273 difference in rent. However, I believe a $150-200 jump in rent is possible. It won’t result in a $41,000 per unit increase, but somewhere in between is still nice.

Some may argue that a two class jump is possible. I think it would be very tough, although not impossible, to jump two class ranks at the top of an up cycle like we are in right now. I don’t think it’s possible to jump two classes from a C- because those are typically located in rough areas. In my opinion, the best probability would be to look at the class with the smallest rent per month difference, which is going from a C to a B-. This represents a $176/month jump in rent. All the other configurations are well over $200/month. This appears to be the 3rd best class to buy for the value.

In summary, I like buying the newest B class asset possible where rents are $1,000/month or more, but of course for the lowest price possible. The goal is to raise rent to as close to $1,150/month or higher for a B+ sale. Alternatively, look for the newer B+ asset (2009 or later) and try to add $150/month or more on the rent to get to a class A sale price. If you prefer to pay less than $100k/unit, then I recommend looking at buying a C class asset as close to 1980s construction as possible then try to get the rent as close to $900/month for a class B- sale.

Happy Buying!